Editor’s note: Seeking Alpha is proud to welcome JH Asset Management as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

courtneyk/E+ via Getty Images

Investment Thesis

Before the COVID-19 pandemic, The Children’s Place (NASDAQ:PLCE) operated like a bond. Each year, the Company generated ~$1.8B in annual sales, resulting in ~$100M of free cash flow that was routinely distributed to investors in full. Beginning in March 2020, this once-steady operation, along with many other retailers, was derailed by lockdowns and the subsequent supply chain disruption. Furthermore, rampant inflation coupled with stagnant wage growth has hurt the financial condition of PLCE’s core consumer. As a result of these events, PLCE’s earnings have plummeted along with its stock price while debt has ballooned.

For those willing to invest with a multi-year time horizon, I believe that these recent misfortunes have provided an opportunity to buy into a very predictable business, returning to its normal state, at a significant discount to intrinsic value. Any concerns about leverage should be assuaged after the Q4 earnings release as a large working capital benefit will be used to reduce debt by ~25%. Furthermore, Management has proactively taken steps to position the business for future success by prioritizing its digital presence as early as 2017.

Company Background

The Children’s Place is a specialty retailer of children’s apparel, selling through a mix of physical stores, its mobile app and websites, international franchises, and wholesale. In 2017, the Company primarily sold through its ~1000 brick-and-mortar stores, which accounted for ~80% of sales, when Management decided to prioritize its online business. Since that time, digital has grown to account for ~60% of sales as of Q3 2023, while its store count has declined to ~590 locations. Remarkably, PLCE’s net sales (that is, net of promotions) have remained practically unchanged as the Company has successfully substituted in-store purchases with digital sales while remaining disciplined on marketing spend.

Durability of Business Model

Besides the valuation, the first characteristic that drew me to the Children’s Place was the business model. Designing and selling (PLCE contracts to manufacture) children’s clothing like t-shirts, jeans, and jackets is so basic that even a simpleton such as I can say with confidence that it is much more likely than not that American moms will still be buying those clothes for their children in at least the same aggregate dollar amount even a century from now. However, it goes without saying that children’s apparel is not exactly a rapidly growing pie either.

Competitive Advantage

While not perfectly competitive, the competition in apparel retail is fierce. There are several players with significant scale (e.g., Target’s Cat & Jack, Gap, Carter’s, etc.), which has resulted in bouts of heavy promotions and marketing spend as players seek to take market share from one another. Despite this, PLCE has been able to successfully generate ~$1.8B of net sales annually over the past 10+ years, which is a clear testament to the Company’s portfolio of brands and its value proposition to the consumer, in my opinion.

Discount To Historical Earnings

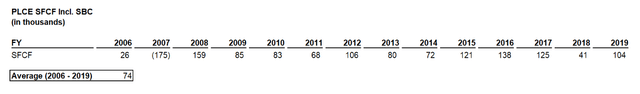

The goal of investing is to buy ownership interests in businesses at valuations below their intrinsic value, the discounted value of future cash flows. That is the game. With that in mind, below is a table that illustrates PLCE’s track record of cash flow generation since FY 2006 (defined as cash flow from operations less capex and stock-based compensation):

PLCE SFCF, Incl. SBC Exp. (Company filings)

That is pre-COVID earnings power of ~$75M, through an economic downturn, relative to a market cap of just ~$300M as of 12/27 for an eye-popping owner’s earnings yield of ~25% (if you believe PLCE will once again earn ~$75M in a more benign environment for apparel retail). Note that adjusting out stock-based compensation expense results in average cash earnings closer to ~$100M.

Management Team

Excess cash generation is important, but it is equally important that your earned cash is not squandered. Thankfully, Management has historically allocated excess cash flow simply – either returning it to shareholders or occasionally funding investments vital to the strength of the business (e.g., acquired Gymboree out of bankruptcy, spent ~$50M to build out e-commerce channel, etc.). Since 2006, Management has returned roughly all excess capital back to shareholders, spending an average of ~$90M per year on share repurchases and briefly paying a dividend. Even though this return of capital seems excessive in hindsight given the Company is now tight on liquidity, I applaud Management’s decision to return capital as children’s apparel is a low-ROI industry. In particular, I think CEO Jane Elfers, who has led the Company since 2010, is a capable allocator who will do right by shareholders. On this point, it’s worth mentioning that she purchased ~$1M of PLCE stock on the open market in July.

What’s The Catch? Leverage

Management will not be returning any cash flow to investors if the business is bankrupt. While this is certainly not the expected outcome, PLCE’s liquidity position is tight. PLCE has a revolver balance of $360M, a $50M term loan outstanding, and $14M of cash and equivalents for net debt of ~$400M. In addition to cash, PLCE has ~$30M of remaining capacity on its revolver for ~$40M of total liquidity. Relative to TTM 3Q 2023 cash flow from operations of -$35M, this understandably looks troublesome.

However, PLCE is expecting a large working capital benefit of $100M by EOY, which it will use to reduce debt. If this proceeds as planned, PLCE will have ~$140M of liquidity available entering 2024. Furthermore, not all debt is created equal, and the bulk of PLCE’s borrowings are on its revolver, so fixed charge coverage is less of a concern. Lastly, now that the input costs that plagued the Company in 2022 / 1H23 are in the rearview mirror, I think it is very likely that PLCE can operate profitably if Mgmt. can remain disciplined on working capital management.

Digestion of Q3 Results

Sales

Sales were ~5% below the historical average for the quarter but ahead of expectations given the difficult spending environment. Management also expects Q4 sales to be down mid-single digits from the historical average. Notably, stronger-than-expected digital sales growth offset brick-and-mortar sales declines. While this is certainly a positive data point for the digital strategy, it also has implications for the gross margin, which caused the bottom-line miss.

Gross Margin

Gross margin was 33.7% in Q3 vs. a 36 – 37% guide and a pre-COVID average of ~40% (gross margin often peaks in Q3). This difference may seem small but PLCE has historically operated at an average net margin of ~4%, so even a 1% drop in GM without any offsetting savings can significantly reduce owner’s earnings. As a result of this drop, the operating margin was only ~10% in Q3, and Management guided to just a 2 – 3% operating margin in Q4 vs. expectations of a 10% margin for all of 2H23.

Management cited 3 reasons for the drop in GM, assigning roughly equal weighting in terms of $ impact: 1. Delayed freight & fulfillment savings, 2. Higher labor costs (employees + 3rd party logistics) as a result of higher than expected package volume, 3. Decline in order dollar size.

Out of the 3, I agree with Management that only the higher labor costs are permanent due to higher wage rates while the rest are transient for the reasons below:

Freight and Fulfillment Contract Savings – Per Management, this benefit is expected to kick in as early as Q4, but they are rightfully prioritizing maximum savings vs. immediate benefits.

Higher Labor Costs – Taking the learnings from this experience, Management should be able to do a better job of appropriately staffing the distribution center to match the expected volume during the back-to-school shopping period going forward. This will enable the Company to avoid paying out unnecessary overtime premiums. Furthermore, PLCE will be less reliant on its outsourced logistics provider to fill orders, especially when the expansion of its distribution center is completed.

Declining Order Economics – I think it makes intuitive sense that overall Average Dollar Sale (ADS) should rebound when PLCE’s customer spending habits revert to the mean. However, I would say that this problem is a bit of a question mark as it is customer-driven, and the Company has not provided data to support this perspective. Furthermore, Management mentioned that ADS is much lower on Amazon, which will dilute the overall ADS as that channel grows. Ultimately, I am trusting Management as well as my understanding of the current retail environment that this problem is cyclical and not structural. Plus, Management has levers available to address this issue such as implementing a minimum order size for free shipping.

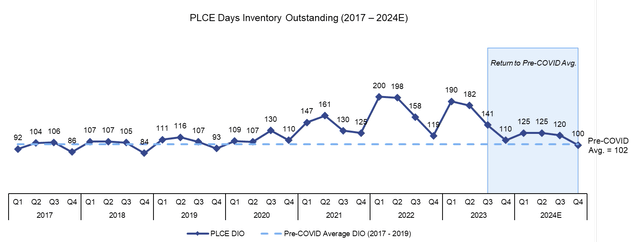

Working Capital

As a result of supply chain problems and softening sales, PLCE’s inventory position has built up. This can be seen in the firm’s days inventory outstanding, which has increased significantly from pre-pandemic levels. Now Management is right-sizing their inventory position to match relatively weaker aggregate demand. In Q3, Management reduced inventory by ~15% from the previous quarter, resulting in a cash benefit of ~$75M that was offset by a paydown of accounts payable. For the same reason, PLCE should be able to generate ~$100M in Q4 to reduce its revolver borrowings as Management is targeting a double-digit reduction in inventory from FYE ’22, which comes out to a minimum of ~$60M. If Q4 sales fall in line with Management’s guide, I see no reason why the Company can’t accomplish this goal given there is substantial historical precedent. In addition to the inventory reduction in Q3, the Company made a similar move in Q4 of last year, generating ~$100M from net inventory liquidation.

PLCE DIO, 2017 – 2024E (Company filings, Author’s estimates)

Beyond 2023, bringing inventory in line with the softer sales environment alone can provide another $100M+ working capital benefit to tide the Company over until the consumer strengthens. If PLCE can accomplish this, it would have ~$250M in available liquidity between its cash and revolver capacity. Alternatively, Management may decide to hold onto some excess inventory in anticipation of a lift in sales. In this scenario, the Company would be even better off, assuming that demand does inflect as expected.

Financial Forecast And Valuation

Trying to predict PLCE’s future sales in any precise way is a fool’s errand as this would require the knowledge of the future discretionary expenditures of millions of PLCE shoppers when in reality, they likely don’t even know how much they plan to spend. Fortunately, the disconnect between PLCE’s current market value and any form of a return to the Company’s former state is so wide that shareholders are bound to still do well if the Company recovers.

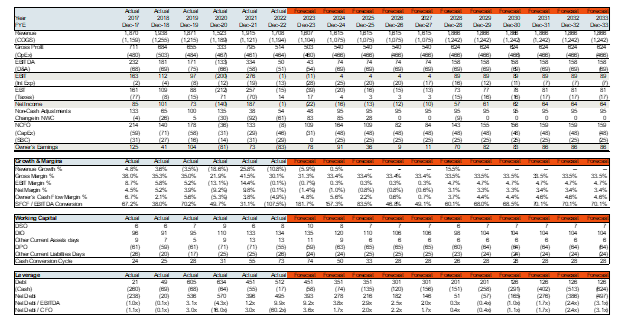

PLCE Financial Forecast, Recovery In 2028 (Public filings, Author’s estimates)

Even in a scenario where PLCE’s sales remain muted until 2028 and overall gross margin never recovers to its pre-COVID average, my analysis suggests that PLCE is likely still undervalued by as much as 100% on a discounted cash flow basis using a fixed discount rate of 10% and 0% terminal growth with the financial forecast in the table above. For revenue, this case pessimistically assumes a run rate of 2023’s sales through 2028 when revenue returns to the pre-COVID average. Similarly, I am assuming an improvement to gross margins from 2023 levels now that input cost pressures have abated, but they are still lower than the pre-COVID average of 36.5%. With a run rate of 2023 SG&A, this implies a breakeven operating margin through 2028. To cover interest expense and capex and reduce debt in this scenario, I would expect Mgmt. to further tighten controls on inventory purchases and continue to reduce its inventory position.

While this scenario is starkly bearish, it serves to illustrate that even a recovery in the distant future could likely still generate an IRR of ~14% (a double in valuation over 5 years) for investors as long as the Company can simply withstand the downturn. On the flip side, I would not be surprised to see returns of 300%+ in the event of a greater recovery in 2024 or 2025, which is certainly in the realm of possibility.

Risks

Hard Landing

Given clothing is a somewhat discretionary expense, PLCE’s sales and margins would be negatively impacted by a recession or general decline in consumption. PLCE navigated the Great Financial Crisis with only 1 year of operating losses and recovered fairly quickly but a prolonged downturn would certainly hurt.

Rise In Input Costs

2022 and 1H23 exposed that PLCE is susceptible to losses from spiking input costs, particularly as the Company was loading up on expensive inventory. Accordingly, investors should keep an eye on the price of cotton and freight costs; however, Mgmt. seems much more cautious about inventory purchases in the current environment, so I would not expect the same magnitude of a decline in margins.

Permanent Decline In Unit Economics

Without question, the gross margin miss in Q3 has spooked analysts and investors about the future profitability of PLCE as a digital-first retailer. While Mgmt. believes that most of the impact was transient, there is a risk that a permanent decline in ADS will offset any savings from store closures. While there may be some truth to this, I tend to think that the bulk of the drop in ADS stems from the current spending environment. Plus, Management is working to address excess labor costs, which exacerbated the impact.

Inability To Further Reduce Inventory Balance

Under circumstances where PLCE cannot operate profitably, Mgmt. will have to fund fixed charges and generate excess cash by reducing its inventory balance on hand and operating with less inventory going forward. However, inefficiencies at its distribution center and stores may force the Company to hold more inventory for longer, tying up capital that could otherwise be used to pay interest and cover capex.

Loss of Market Share To Competitors

Given that PLCE operates in an industry with high competition and low barriers to entry, there is always a risk that the Company can lose market share to competitors. This could negatively impact PLCE in multiple ways including forcing PLCE to increase promotions, lower prices, increase marketing spend, etc.

Conclusion

Given that PLCE has returned to profitability and plans to reduce borrowings in the ballpark of ~$100M, I would say that Q3 was a successful one even though Management revealed some new challenges that the Company will have to grapple with moving into next year. Fortunately, nearly all of these issues should be mitigated by near-term operational improvements and the inevitable recovery of PLCE’s core shopper. Therefore, I think time is on the side of PLCE shareholders who will ultimately be rewarded for their patience and continued optimism for the future of the business.

Author’s Note: Shoutout to Kingdom Capital Advisors, The Bulls Bay, The Small Cap King, Eagle Fang Capital, and many others who have been covering PLCE longer than I have. I highly recommend that you check out their work as well.