cagkansayin

We previously covered 3M (NYSE:MMM) in October 2023, discussing the company’s normalizing top-line from the hyper-pandemic growth and the uncertainty from the ongoing legal settlements.

However, we had also believed that the stock had been oversold then, triggering its attractive investment thesis for opportunistic income oriented investors, since the worst might already be over, further aided by the raised FY2023 guidance.

In this article, we shall discuss why the MMM stock valuations may be re-rated nearer to its peers and historical means, thanks to its highly effective cost optimization efforts and growing bottom-line.

While there may be minimal top-line growth ahead, we believe that its dividend investment thesis remains robust with a potential capital appreciation as the headwinds subside.

The MMM Investment Thesis Remains Robust Despite The Recent Recovery

For now, MMM has reported a double beat FQ3’23 earnings call, with revenues of $8.31B (inline QoQ/ -3.6% YoY) and adj EPS of $2.68 (+23.5% QoQ/ inline YoY).

Much of the bottom line tailwind is attributed to its steady gross margins and the management’s aggressive cost controls, with a moderating adj operating cost of $2B (-14.5% QoQ/ -16.3% YoY).

This feat is impressive indeed, despite the ongoing litigations and progressing spin-off of its healthcare business by H1’24, which may further drive the efficiency of its business operations while improving its profit margins.

Perhaps this is why the MMM management has also raised its FY2023 guidance with an adj EPS of $9.05 (-10.3% YoY) and adj operating cash flow of $6.7B (+19.8% YoY) at the midpoint.

This is compared to the original midpoint guidance of $8.75 (-13.3% YoY)/ $6.05B (+9.1% YoY) offered in the FQ4’22 earnings call and raised guidance of $8.85 (-12.3% YoY)/ $6.1B (+9.1% YoY) offered in the FQ2’23 earnings call, respectively.

These numbers further indicate that the MMM management’s drastic restructuring through the layoff of 8.5K global headcounts, or the equivalent 9.2% of its FY2022 headcounts of 92K staffs have worked as intended, despite the projected decline in its full year organic sales by -5%.

The company’s improved profitability has directly contributed to its healthier balance sheet, with a growing cash/ equivalents of $5.21B (+20.8% QoQ/ +45.5% YoY) and moderating long-term debts of $12.87B (inline QoQ/ -7.8% YoY).

This is on top of the sustained shareholder returns, with 15.7M shares retired and $6.00 of dividends per share paid out over the last twelve months.

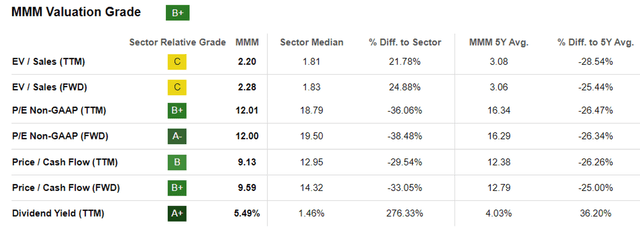

MMM Valuations

Seeking Alpha

Perhaps this is why MMM’s FWD P/E valuation of 12x and FWD Price/ Cash Flow valuation of 9.59x have moderately recovered from its October 2023 bottom of 9.01x/ 7.14x and finally nearing the sector median of 19.50x/ 14.32x though still far from its 3Y pre-pandemic mean of 20.38x/ 18x, respectively.

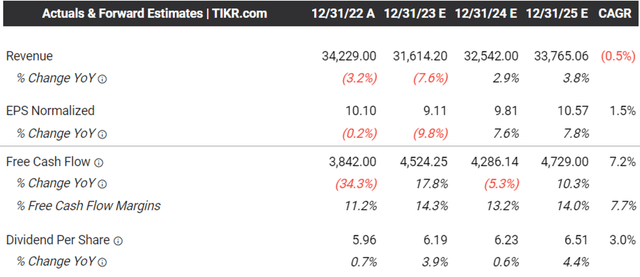

The Consensus Forward Estimates

Tikr Terminal

The consensus also estimates growing FCF generation and expanding dividend per share of up to $6.51 through FY2025, with the latter implying a decent CAGR of +3% compared to its 3Y historical CAGR of +1.64%.

The Seeking Alpha Quant also graded MMM’s Dividend Safety as B+, with a TTM Interest Coverage ratio of 8.57x and TTM Dividend Yield to Dividend Payout Ratio of 8.32% compared to the sector median of 7.04x and 5.24%, respectively.

With 65 consecutive years of dividend growth and payments, this stock may continue to be a dividend aristocrat for many years to come indeed, with the drastic correction since the May 2021 top proving to be a gift.

Anyone concerned about MMM’s legal headwinds may also be rest assured, with the latest developments from the ongoing Combat Arm earplug settlement and PFAS Public Water Systems settlement proving to be promising.

For reference, the Combat Arms verdict has been confirmed on August 29, 2023, with a $6B payment through 2029, with $250M already tentatively paid on December 27, 2023, to the Qualified Settlement Fund for claimants seeking expedited payments.

In addition, the $10.3B PFAS settlement agreed on August 31, 2023, has already received preliminary court approval, with a final approval expected by February 2024.

These developments may conclude two of MMM’s largest legal headwinds, with the other remaining litigation to be its Respirator Mask/Asbestos issue. Even then, we do not expect massive bottom line impact, with the company estimating $601M of “future claims that may be filed approaching the year 2050.”

As a result, we have good reason to believe that the worst may already be over.

So, Is MMM Stock A Buy, Sell, or Hold?

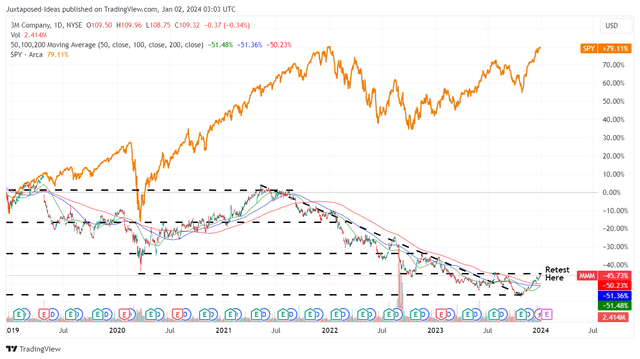

MMM 5Y Stock Price

TradingView

Perhaps this is why MMM appears to be well supported at the $80s, with the stock rapidly bouncing off to break out of its 50/ 100/ 200 day moving averages, significantly aided by the lifted market sentiments from the cooling inflation and potential Fed pivot by Q1’24.

Despite the +23.8% recovery, we maintain our Buy rating here.

With the US Treasury Yields already moderating from previous highs to between 3.85% and 5.33%, we believe that MMM still offers a viable dividend investment thesis with excellent forward dividend yields of 5.49%, against its 4Y average of 4.26% and sector median of 1.47%.

This is on top of the potential capital appreciation by +57.2% to our long-term price target of $172.10, based on the consensus FY2025 adj EPS estimates of $10.57 and the stock’s 5Y normalized P/E valuation of 16.29x.

As a result of the (prospective) dual pronged returns and its well supported floor at $80s, MMM remains a compelling buy for value oriented investors.