da-kuk

My thesis

Marvell Technology (NASDAQ:MRVL) has delivered solid growth over the recent years, driven by nearly all its business segments. The acquisition of Inphi in 2011 was the missing part of connecting the computing and storage data center business to high-performance data transmission. The stock valuation was priced for perfection back in early 2022. Since then, nearly all business lines started to slow down and eventually decline. Such disappointment, in conjunction with a higher discount rate, led to a severe stock correction. Through this analysis, I intend to describe Marvell’s business model, assess its strengths and weaknesses, and set up a DCF model. Taking into account solid growth assumptions, I still see limited upside potential ahead. Despite the high-quality elements of the business case, I opt to stay on the sideline and wait for a better opportunity. I’m rating the stock as a HOLD.

Investment overview

The company turnaround happened in 2016 when Matt Murphy became CEO, having served in different roles within Maxim Integrated for 22 years (a semiconductor company then acquired by Analog Devices) and being a board member of the US Semiconductor Industry Association giving him a unique view on the industry. Once at Marvell, he implemented a restructuring plan and launched a succession of acquisitions to transform the company.

In 2018, Marvell acquired Cavium for $6bn (cash & equity) in a move to diversify its business away from the storage market and go deeper into the networking segment. Marvell then doubled down when it acquired Inphi in April 2021 for $10bn (cash & equity) at a multiple close to 10 times EV/Sales which was expensive but justified by the growth profile of Inphi, its advanced R&D and expected synergies between both groups ($125m run-rate savings after 18 months and revenues synergies of $400m). Inphi is a leader in data center interconnects (within and between centers) and owns a large portfolio of silicon-photonics (transfer of data through light). In August, of the same year, Marvell acquired Innovium for an enterprise value of $1bn (via equity) to further penetrate the segment of cloud Ethernet switches. Its revenues are expected to reach $150m for FY23, implying an EV/sales multiple of 6 times.

As a consequence, Marvell just built a best-in-class networking data center segment, currently representing 40% of its revenues: combining computing capabilities (via ASIC, SoC, and DPU processors), as well as silicon photonics solutions (coming from Inphi) and traditional storage controllers. It is now a one-stop-shop solution for enterprises and data centers.

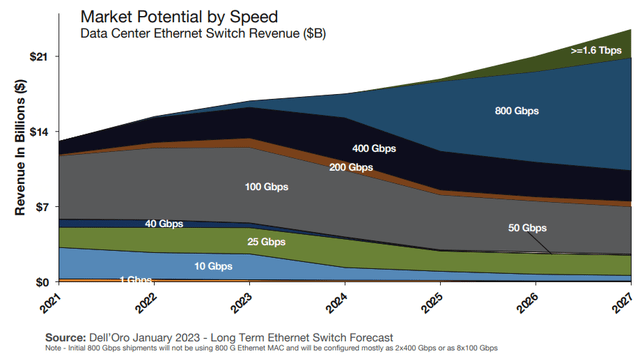

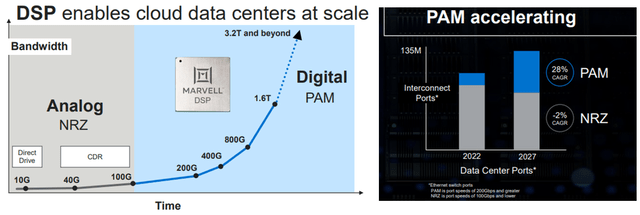

Let’s dig more into segment details and start with the data center networking segment. It is composed of a complete portfolio of high-speed optical communication semiconductors for inside cloud data centers, between cloud data centers, and in carrier networks. Marvell’s electro-optical products include PAM (pulse amplitude modulation), coherent DSPs (digital signal processors), silicon photonics, and other solutions. Demand for DSP will increase along with AI workloads as we can see in the pictures below. Inphi’s acquisition, while expensive, was made at the right time. It happened just before the acceleration of AI developments that favor higher transfer speeds such as 400G/800G PAM transceivers.

Dell’Oro

As a consequence, Digital PAM should continue to gain market share against legacy Analog NRZ technology (100G< speeds).

Marvell

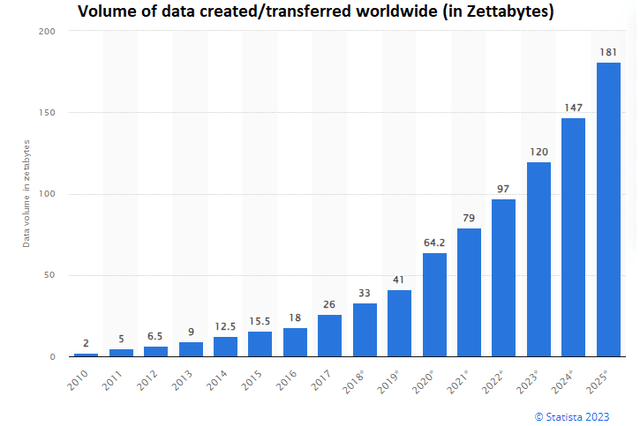

According to Cisco, 85% of data generated and transferred stays within the data center infrastructure while only 15% goes directly to the end-user. It is therefore necessary to strengthen this infrastructure, not only from a computing power angle (GPU, CPU, ASICs, FPGAs, DPUs) but also from a networking point of view. The exponential growth of the internet traffic data will require more networking bandwidth but also more efficient switches to serve the fast-growing IA application market.

Statista

The transition toward 400Gb per second and beyond will require PAM4 technology where Marvell has a position of strength in a duopoly with Broadcom (AVGO). Inphi’s optical transceiver modules are used to convert electrical signals from switches into optical signals, and vice-versa. The strength of such a method is that light is much more efficient to transfer data. The speed of light is equal to 3.10^8m/s versus close to 2.10^8m/s for electrons, so electrons transiting into a copper wire move at 70% the speed of photons. For high requirements of data center infrastructures, such differences matter.

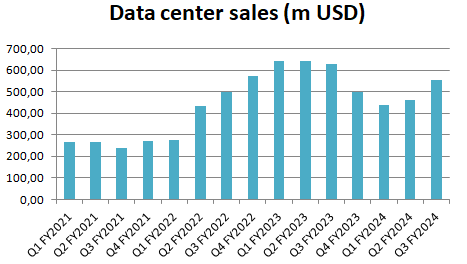

Marvell also disposes of data processing units (DPUs, Octeon ARM-based chip) that help handle networking offloads. After two-quarters of sequential decline, dragged down by storage for the data center (one-fourth of the segment), recent trends in Q2 and Q3 indicate a clear rebound is ahead of us. During the Q3 FY24, the data center was the bright spot: growing by +21% QoQ, above expectations. The management said 800G networking is ramping well while the first 1.6T shipments are expected in the second half of 2024. Q4 guidance shows signs of strength: it is likely the past $200m IA revenues per quarter trajectory will be beaten.

company data

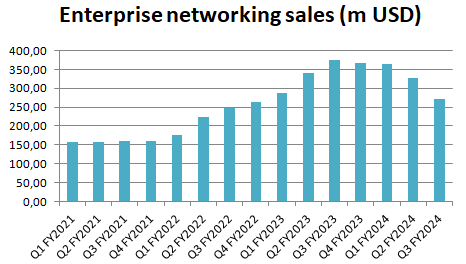

Marvell also leverages its product line within the traditional Enterprise networking segment (19% of sales) has been growing steadily over the recent quarters. The Q3 was particularly weak, decreasing by -17% QoQ. Inventory levels are elevated.

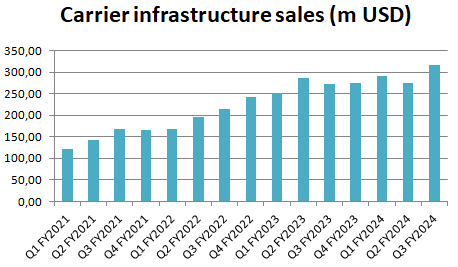

Carrier infrastructure results were above expectations (thanks to a strong product cycle) and now represent 22% of sales. 5G solutions include various components including ASIC processors that are displacing initial installations of FPGAs within band stations. Telecom CAPEX plans in the US, Europe, and developed nations are still ongoing, despite having slowed down recently, and have a large room for deployments. India could also add to future spending growth. The main clients are Nokia (NOK), Ericsson (ERIC), and Samsung (OTCPK:SSNLF). The carrier infrastructure company segment has been quite strong over the two recent years but has been showing signs of weakness during the last quarter.

The CEO expects they will decline as soon as for the next quarter: “However, we have been forecasting for some time that this wave of above-market wireless growth would start to decline” and added that “Demand is continuing to soften as carriers are managing capex… following an extended multiyear period of growth”. It is difficult to estimate how much time such investment spending slowdown will last, but the coming Q4 seems tough: the management sees a 40% QoQ reduction of the carrier end-market. Marvell market share gains thanks to its superior products and new design wins could offset a part of such decline.

Both segments should underperform in the near term, as the CEO recently said: “You’ve seen it in announcements from the big enterprise companies and you’ve also seen it from the carrier companies. It’s a very weak environment.”

company data

company data

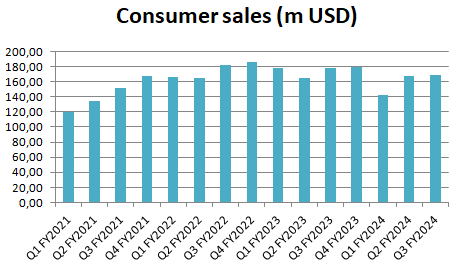

The consumer segment, representing 12% of sales, is also weak. No clear rebound should happen in the near term. Marvell consumer segment has experienced a volatile evolution over the recent years and should be less important going forward in terms of total sales as other business lines should grow at a faster rate. It is, in my opinion, the least valuable segment.

company data

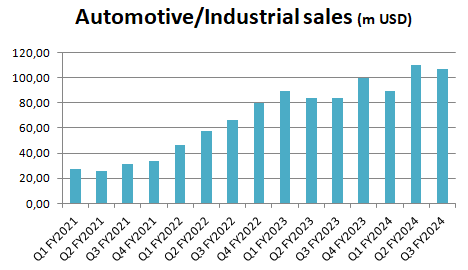

Finally, the smaller segment and fastest growing has been the automotive and industrial unit, representing 8% of total sales. Quarterly revenues grew from $20m in 2021 per quarter to $100m recently, driven by an increasing content of Ethernet connectivity within cars. However, the Q3 showed signs of cracks as QoQ growth was slightly negative, and the management sees the industrial part to decline significantly in the Q4 with a sharp decline to come close to 20% QoQ as aerospace and defense soften.

company data

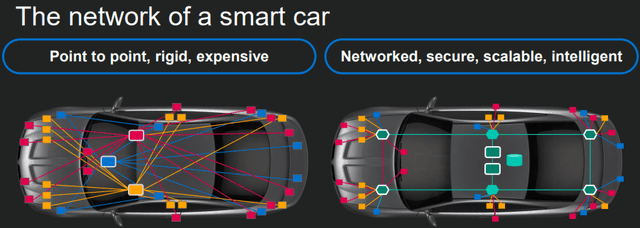

Arista Network’s auto portfolio includes Ethernet physical-layer transceivers, bridges, and switches supporting speeds up to 10Gbps with enhanced safety and security features required for advanced driver assistance systems (ADAS), central gateways, body domain controllers, vehicle cameras, and in-vehicle infotainment. The transition to higher average price vehicles is requiring more expensive content for Marvell (from $8 Ethernet design per car versus above $50 per car for more advanced models). In 2021, during its investor day, the firm estimated the car Ethernet market to reach $1bn in the medium term and that it could reach at least 50% market share. As can be seen in the following picture, Ethernet-based car infrastructure allows for the centralization of data and the simplification and optimization of the internal structure. In the picture below, we can see that Ethernet-based car infrastructure allows for the centralization of data and the simplification and optimization of the internal structure.

Marvell 2021 investor presentation

What valuation can we expect?

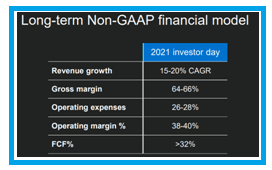

During Marvell’s 2021 analyst day, the management set long-term financial targets that can be seen here below.

Marvell 2021 Investor Day

Of course, part of the high growth revenue trend came from solid backlogs accumulated (in the infrastructure and enterprise segments), the addition of Inphi leading to inorganic growth and also from positive base effects post-COVID when the activity rebounded. Adjusting from such ramp-up, we could imagine the normalized organic growth rate of Marvell to be close to double-digit (~10% CAGR) instead of 15%-20%. I did take into account this adjusted growth scenario.

Concerning operating expenses, converged in the medium term toward what the management expected (in non-GAAP metrics): 66% gross margins and, an EBIT margin of 40%. In the longer term, I did model EBIT margin to reach 45% as operating leverage and a segment mix increasing toward higher-margin data center sales could lift the profitability further.

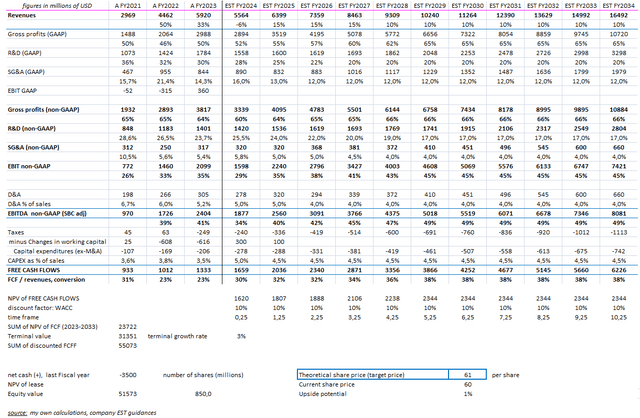

own calculations

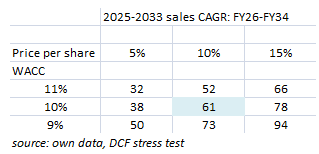

Given this model, a terminal growth rate of +3%, and a WACC of 10%, I obtain a share price of $61/share, which means the stock is fairly valued.

In addition, I implemented a sensitivity analysis to give more perspective, varying the discount rate and mid-term growth. We can see that a CAGR of 15% per year for several years is required to justify a clear upside potential. Such a hypothesis is quite difficult for me to take into account in my main model as it would require the data center and auto segments to generate exponential growth ahead.

own calculations

Balance sheet analysis

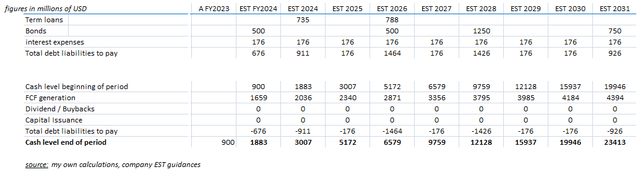

As a consequence of Inphi’s acquisition in 2021, the number of shares increased significantly from 669m to 851m over the last three years. The debt level also rose to complete the financing. This led to a net debt position of $3.5bn including $4.4bn of financial debt and $0.9bn of cash at the end of FY23. According to my calculations, the ND/EBITDA should be 1.5X by FY24 while I expect it to fall toward 1X for the next fiscal year. The liquidity table here below doesn’t exhibit any issue: Marvell could act opportunistically and acquire new assets if needed to strengthen its core data center business.

own calculations

Risks

The main risk relates to competition, as Marvell is facing larger competitors. Qualcomm has a scale and financial resources for investing large amounts in R&D. Also, Cisco’s acquisition of Luxtera in 2019 could help the networking giant penetrate silicon photonics.

Another risk I would highlight concerns the company valuation which assumes double-digit growth of FCF over the coming years. While Marvell’s data center portfolio and auto segment are impressive, they just represent half of its revenues. The rest consist of medium-quality assets (enterprise, telecom) to low concerning the consumer part. Any investor doing a sum-of-the-part valuation could be tempted to assign a lower P/E multiple to these slower-growth assets. In other words, Marvell’s growth assets have to significantly outperform to justify a 4% FCF yield (P/E~25X) valuation for the whole business.

Technical analysis

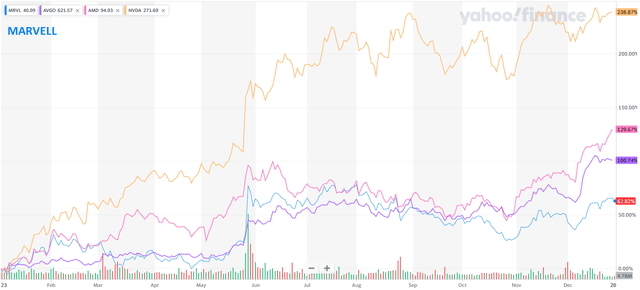

We see that Marvel’s peer group price performances have been indeed highly correlated. Its YTD performance has been weaker than some of its competitors as quarterly results have disappointed the market. A part of Marvell’s valuation relies on speculation that IA will be a key driver.

Yahoofinance.com

Conclusion

Marvell’s business model is solid and the management deserves credit for having built up with patience a high-quality data center unit. However, this segment alone cannot compensate for weaker trends in other business lines. Patience is needed as elevated valuation multiples require more segments to participate in the revenue recovery. I am rating the stock as HOLD and waiting for a better entry point.