jetcityimage/iStock Editorial via Getty Images

Introduction

2023 was a great year. Although I underperformed the S&P 500 due to my decision to stick to dividend (growth) stocks in a market that benefitted growth stocks, I was able to significantly increase some of my favorite investments, including Norfolk Southern (NYSE:NSC).

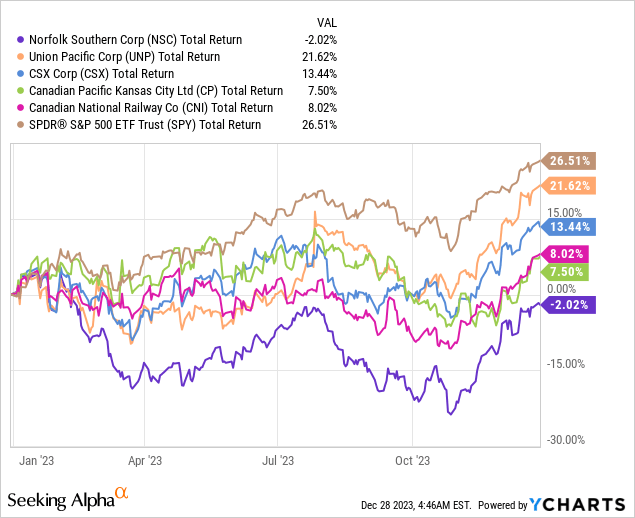

Year-to-date, Norfolk Southern is the only railroad with a negative performance, including dividends. All other Class I railroads have performed better. Union Pacific (UNP), which is one of my largest holdings, came the closest to the 26.5% performance of the S&P 500.

Essentially, there are two main reasons why Norfolk Southern is lagging behind its peers:

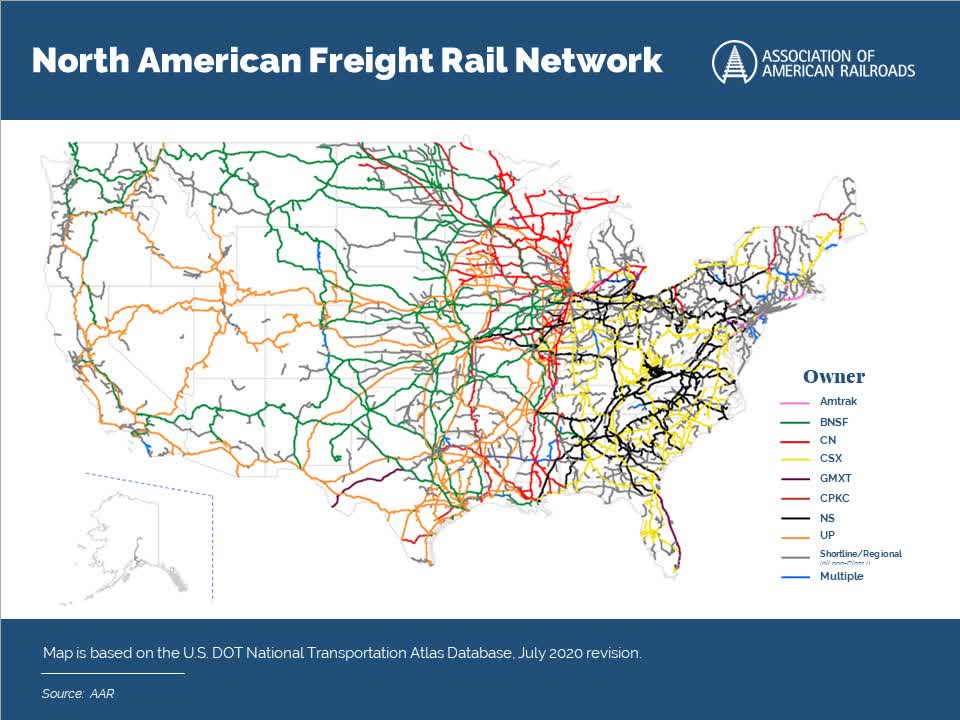

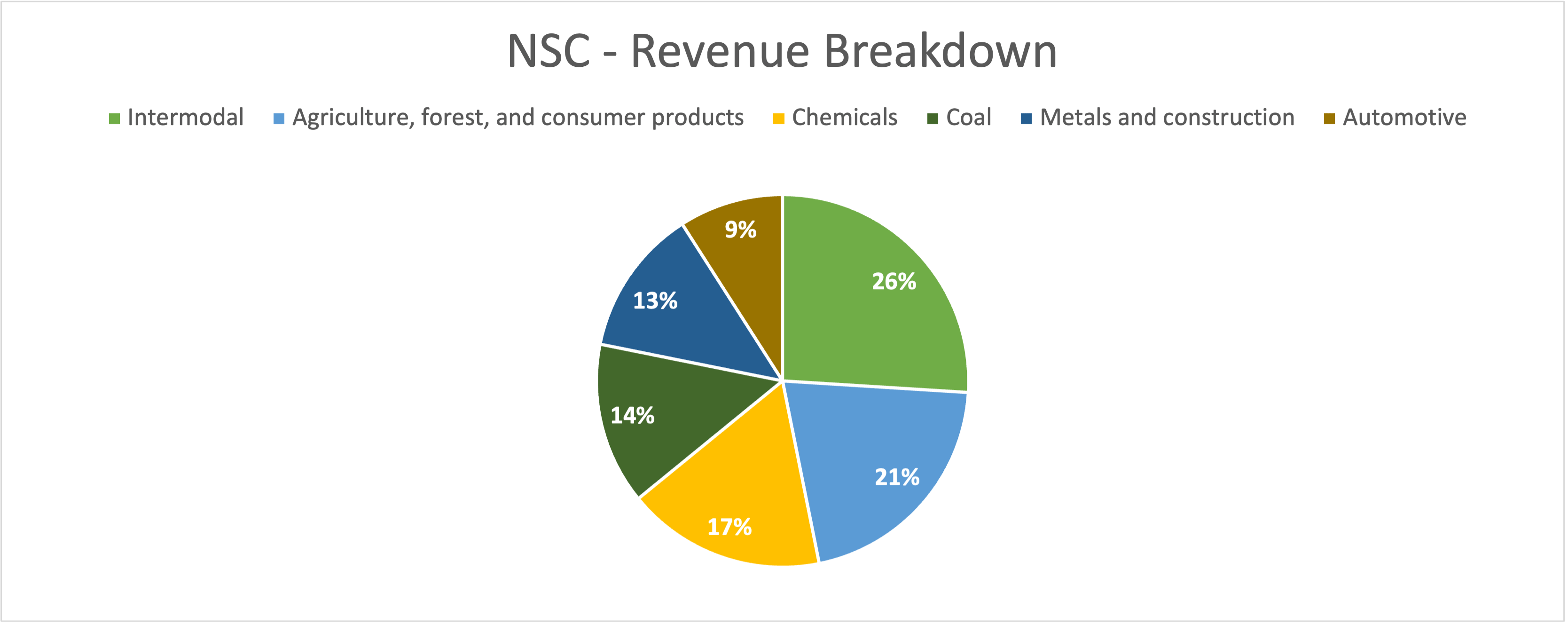

- The company is an intermodal-focused railroad. In other words, it depends on consumer health and has less exposure to high-margin bulk shipments than most of its peers. Roughly a quarter of the company’s revenues are generated in the intermodal segment, which services all major economic hubs in the Eastern part of the United States.

Association of American Railroads

- Earlier this year, it had to deal with a catastrophic derailment in East Palestine, Ohio, which resulted in close to a billion dollars in additional expenses, a bad reputation, and high uncertainty regarding potential future costs.

Leo Nelissen (Raw data: Norfolk Southern)

However, instead of panicking, I used weakness to add to my position.

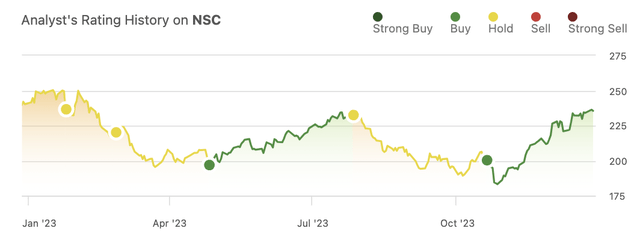

As we can see below, my two bullish articles this year were written close to the bottom. My most recent article was written on October 20, when I went with the bullish title “I’m Buying Norfolk Southern Stock With Both Hands.”

Seeking Alpha

Since then, NSC is up almost 18%, beating the S&P 500 by more than 400 basis points.

The reason I’m writing this article isn’t to brag. After all, there’s nothing to brag about. NSC’s full-year performance is still poor.

In this article, I’m focusing on the risk/reward going into 2024. I’m using recent economic developments, the company’s presentation at last month’s Stephens Investment Conference, and very important developments in the intermodal industry, which could pave the road for above-average long-term growth.

So, let’s get to it!

Tailwinds Despite Economic Headwinds

Before we discuss the good news, we have to briefly take another look at the bad news. Although I discussed the company’s 3Q23 results in October, I’m taking a brief detour to remind everyone why NSC has been doing so poorly this year.

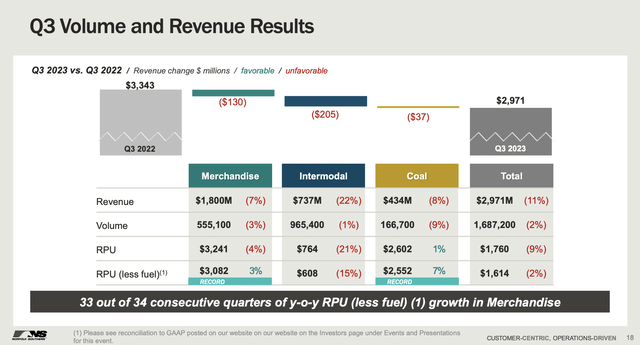

In the third quarter of 2023, the company reported an 11% decline in revenues, primarily attributed to a significant reduction in fuel surcharge revenue.

Volumes were down by 2%, translating to a $74 million revenue decline. Additionally, a reduction in intermodal storage revenue, amounting to $71 million, contributed to the overall decline in revenues.

Norfolk Southern

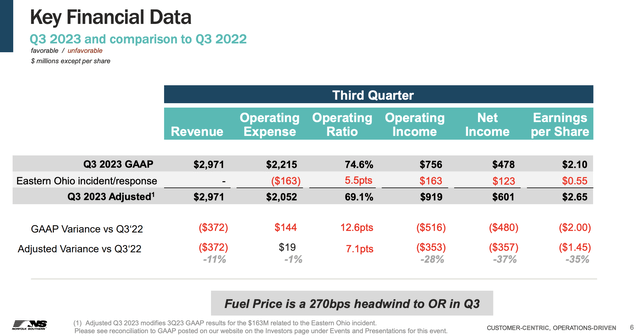

Even worse, the overall adjusted operating ratio for the third quarter was 69.1%, including a notable 270 basis points of headwind from net fuel price impacts.

Operating income, on an adjusted basis, saw a decline of 28%, and net income and earnings per share were down by 37% and 35%, respectively.

Norfolk Southern

With that in mind, roughly a month ago, the company presented at the Stephens Annual Investment Conference, NASH2023, where it discussed both headwinds and opportunities.

One of the most notable comments was that the railroad is experiencing a notable uptick in weekly volumes, reaching levels not seen in approximately 18 months.

This surge was attributed to improved service, positioning the company for increased business opportunities.

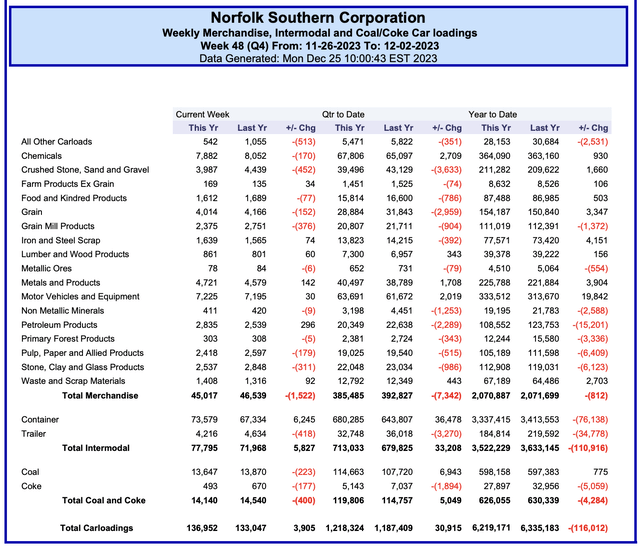

Looking at the company’s most recent weekly transportation numbers, we see that growth has returned.

For example, year-to-date, total carloads are still down 116,000 units.

However, quarter-to-date, carloads are up 31,000 units, with strong growth in intermodal, which more than offsets declines in merchandise.

Norfolk Southern

Going forward, the company expects growth opportunities in merchandise and intermodal markets, as it anticipates volume growth in these sectors, leveraging existing train capacities.

These markets were highlighted as areas with significant growth potential, supported by a robust plan for service improvement and productivity.

Furthermore, the company observed elevated volumes in automotive shipments year-over-year, indicating strength in this sector.

Additionally, there is a robust demand in markets associated with non-residential construction.

Nonetheless, the decline in economic growth is also causing persistent headwinds, as the company noted ongoing weaknesses in certain markets, particularly in chemicals, domestic coal, and energy sectors.

In light of inflation challenges, the good news is that the company remains committed to a pricing strategy based on the value of its product, distinct from inflation-plus pricing or cost-plus pricing.

During the Stephens conference, Norfolk noted the challenge of fully incorporating inflation into contracts due to the average duration of contracts being about 2.5 years.

However, the company is confident in its ability to secure prices in excess of inflation over the long term.

With that said, the company also commented on a whole range of longer-term opportunities, which I want to discuss in the next part of this article.

Norfolk’s Long-Term Opportunities

Earlier this month, I read an interesting article on FreightWaves, which was titled “Can Intermodal Rail Increase Its Market Share By 25% By 2030?”

As Norfolk Southern is an intermodal heavyweight, this applies to the company.

FreightWaves

According to the report, the U.S. intermodal container traffic may be experiencing a downward trend in 2023, but a recent report from consulting firm Supply Chain Ecology, commissioned by the Environmental Defense Fund (“EDF”), emphasized that intermodal rail remains a viable strategy for long-term growth in the North American freight rail industry.

The report puts forth five recommendations to enhance the role of intermodal rail. Here are the four biggest pieces of advice that apply to railroads like NSC:

- Integration of Short-Line Railroads: Encourage collaboration between short-line railroads and Class I railroads through haulage agreements.

- Development of Intermodal Hubs: Expand the network of intermodal hubs to facilitate rail-to-truck transfers, particularly utilizing short lines.

- Advancements in Freight Technology: Embrace innovations such as autonomous rail cars and technologies for improved traffic management.

- Freight Intelligence Tools: Develop tools enabling shippers to access data on service reliability and cost-related metrics.

As I discussed in prior articles, by implementing new growth measures, railroads can benefit from the fact that railroad transportation is much more efficient (and better for the environment) than trucking.

Going back to the Stephens conference, the company noted that it aims to regain market share from the trucking industry. The CEO, Mr. Alan Shaw, emphasized that rail has historically ceded share to trucks primarily due to service issues.

The company is addressing this by presenting a “better way forward,” focusing on investments in the cycle and committing to providing a consistently high-quality service product through various market conditions.

Essentially, the company envisions a relatively quick conversion from truck to rail for certain customers, particularly in the merchandise and automotive businesses.

The key factor influencing this conversion is the ability to consistently provide high-quality service through economic cycles.

Norfolk Southern is actively working with channel partners to expand its intermodal business, targeting a broader customer base beyond the existing ones.

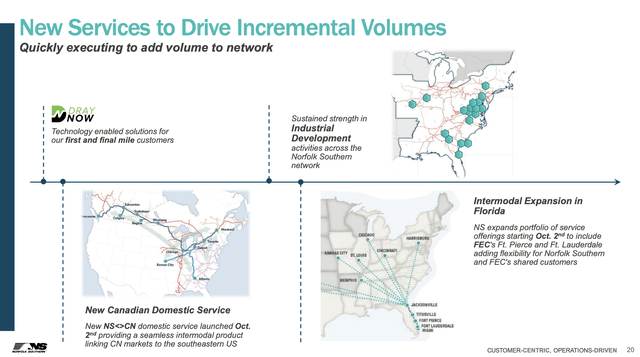

Norfolk Southern

The Atlanta-based railroad is also benefitting from another megatrend I often mention: supply chain re-shoring/near-shoring.

NSC sees itself in a manufacturing supercycle driven by significant investments in new factories, particularly in the Southeast and Midwest regions of the United States.

Notably, the EV market presents substantial growth opportunities, with $70 billion of EV investment announced in North America, $30 billion of which is on Norfolk Southern’s lines.

If more companies move production to the U.S. or North America, in general, it requires transportation solutions. That’s how straightforward it is.

Now, it’s up to the company to improve its services to attract new customers and close attractive long-term deals.

Related to this, as we can see in the screenshot above, Norfolk Southern is actively collaborating within the supply chain ecosystem.

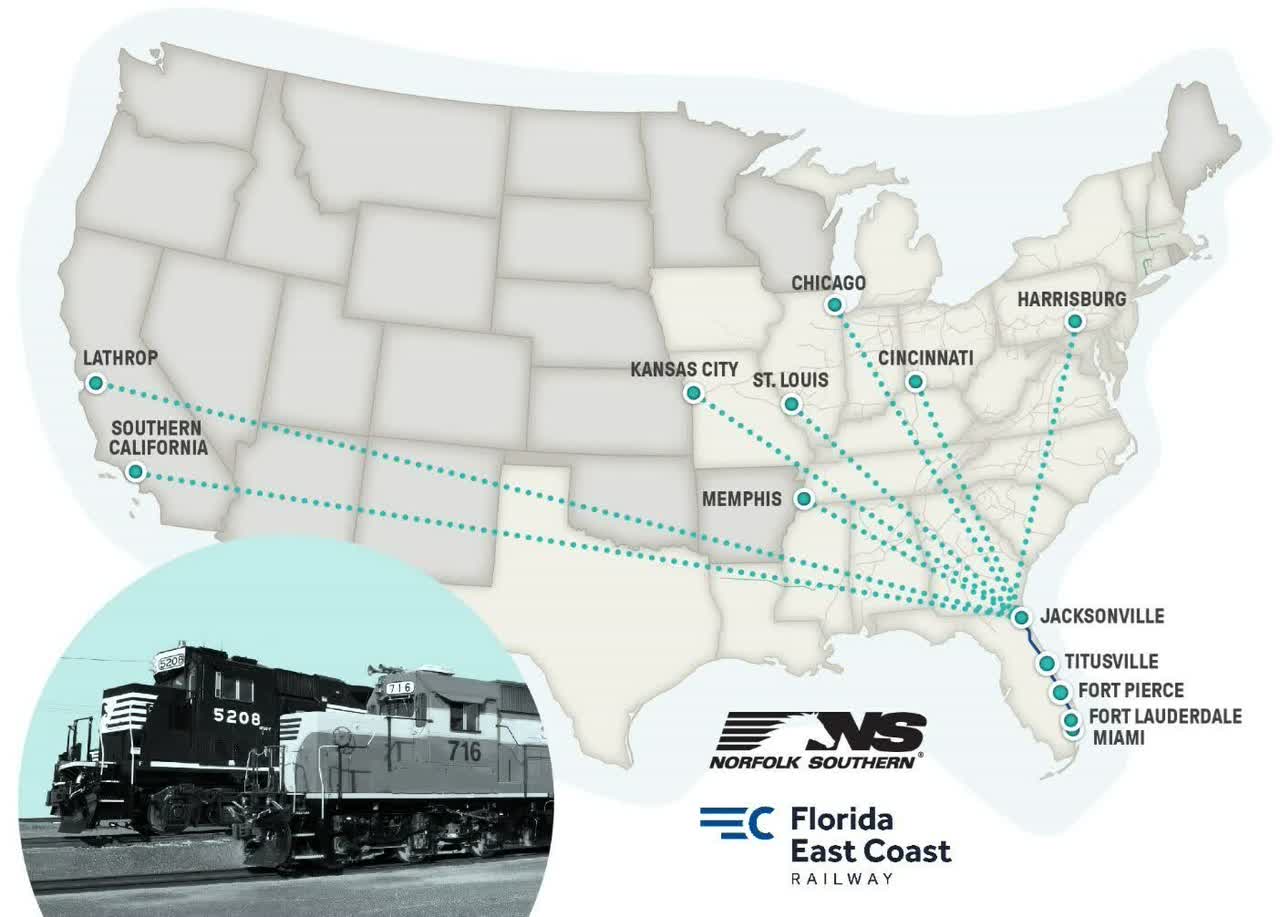

Recent partnerships with FEC and Canadian National (CNI) demonstrate a commitment to working closely with other rails.

Starting on October 2, Norfolk Southern will expand its existing portfolio to include FEC’s Ft. Pierce and Ft. Lauderdale intermodal terminals. This complements current service to FEC terminals in Titusville and Miami. The result is added flexibility for Norfolk Southern and FEC’s shared customers. It also expands direct access to and from markets in Chicago, Cincinnati, Harrisburg, Kansas City, Memphis, St. Louis, Lathrop, and Southern California.

Norfolk Southern/FEC (Via P.R. Newswire)

The company also collaborates with over 260 short lines, focusing on first-mile and last-mile efficiency.

The goal is to provide a more efficient end-to-end solution that can effectively compete with trucking, aligning with the company’s vision for success in the supply chain ecosystem.

Please note that these are also findings from the FreightWaves report I mentioned in this article.

Dividends & Buybacks

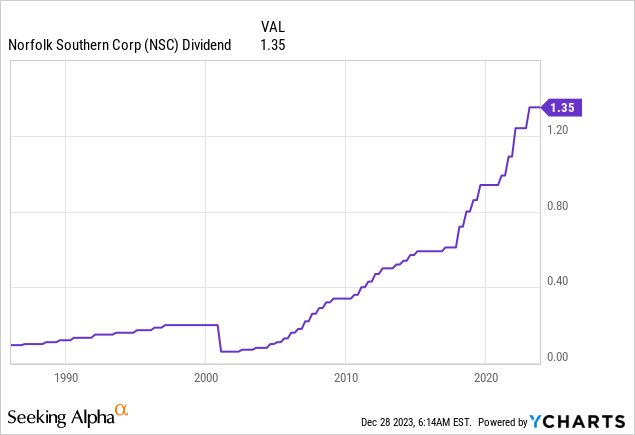

On top of working on long-term growth opportunities, NSC is a dividend growth stock with a great track record.

Currently yielding 2.3%, the railroad has a healthy payout ratio of less than 45%. Its five-year dividend CAGR is 12.2%. The company has hiked its dividend for seven consecutive years.

During recessions, it tends to keep its dividend unchanged, which is fine with me, as I don’t mind it when companies prefer balance sheet protection over achieving dividend aristocrat status.

Since the early 2000s, the company has never cut its dividend.

On top of a safe dividend payout ratio, the dividend is also protected by a healthy balance sheet with a net leverage ratio of less than 3x EBITDA (despite recent growth challenges).

The railroad has a BBB+ credit rating, which is one step below the A range.

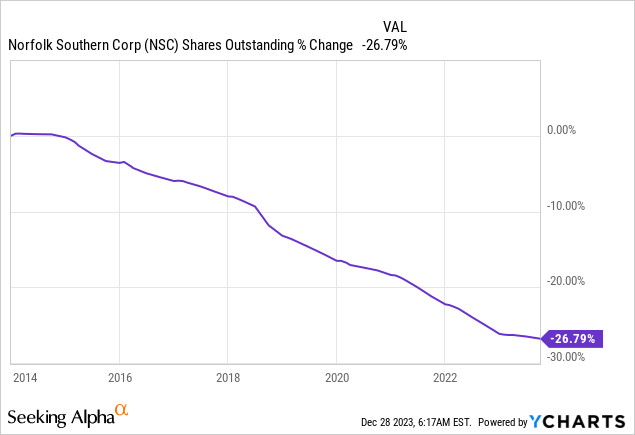

Thanks to a healthy balance sheet, the railroad is able to spend excess cash (after capital investments and dividends) on buybacks.

Over the past ten years, NSC has bought back 27% of its shares.

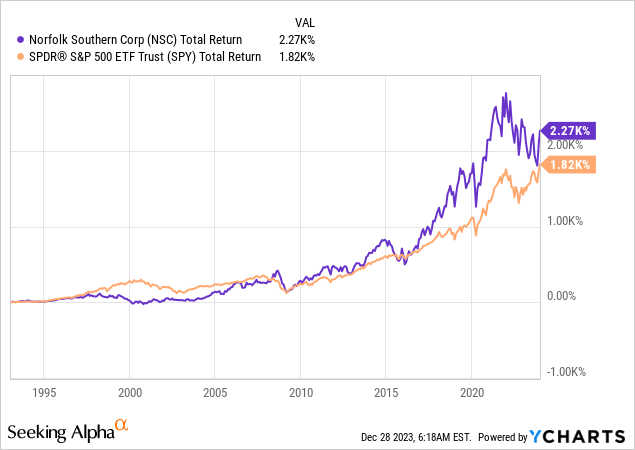

Consistent dividend growth and aggressive buybacks have allowed the company to beat the market on a prolonged basis.

With that said, let’s take a closer look at the valuation.

Valuation

Because I bought NSC quite aggressively this year and its strong recent performance, it is now the 9th-largest holding of my 20-stock portfolio.

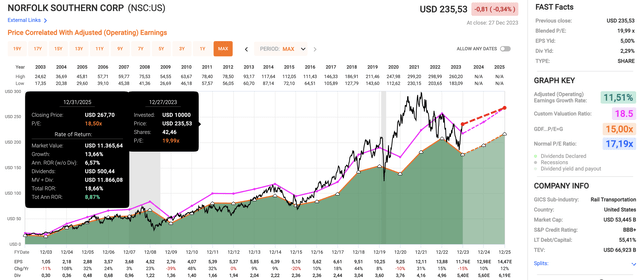

NSC shares are currently up almost 30% from their 52-week lows, which has pushed the blended P/E ratio to 20.0x, as we can see in the overview below.

Furthermore:

- The company’s multi-decade normalized valuation multiple is 17.2x. In recent years, it has traded closer to 18.5x, which is why I went with that as a “normal” valuation. It’s displayed by the pink line in the chart below.

- This year, EPS is expected to fall by 15%, followed by an expected recovery of 10% in 2024 and 12% growth in 2025.

- Based on an 18.5x multiple and expected growth rates, the stock has a fair price target of roughly $268, which is roughly 14% above the current price.

FAST Graphs

This price target would imply a 9% annual total return through 2025, including its dividend.

With everything said so far, I’m looking to buy much more NSC stock in 2024, as I believe in its future plans and the potential of its increasing footprint in the North American rail industry.

However, given its valuation and ongoing economic challenges, I prefer to wait for a 10-15% pullback in its stock price.

At that point, I believe the risk/reward is very attractive for long-term investors.

My rating remains Bullish, as I think this company remains in a great spot to beat the market on a long-term basis.

Takeaway

Positioned as an intermodal heavyweight, NSC stands out with a strategic focus on regaining market share from the trucking industry.

The commitment to offering consistently high-quality service, investments in the supply chain ecosystem, and collaborations with key partners like FEC and Canadian National highlight a forward-thinking approach.

Meanwhile, the company’s active role in reshaping supply chains, coupled with its pivotal role in the EV market, underscores NSC’s significance in the evolving transportation landscape.

With a resilient dividend track record, strategic buybacks, and a good outlook, NSC is on my buy list for 2024.