BlackJack3D

I first wrote about VERSES AI (NEOE:VERS:CA) (VRSSF) in October. It was the first coverage of the stock by an analyst on Seeking Alpha, and in that article, I did a detailed coverage of what the company does, its approach to AI development, and some of its products. For those who might not know much about VERSES AI or who have just known about the company after coming across VERSES AI’s recent New York Times-published open letter, invoking the OpenAI “assist” clause for collaboration on artificial general intelligence (AGI), VERSES AI is a cognitive computing company that takes a neurobiological approach to AI development. This approach gives AI next-gen abilities, modeled after “the Wisdom and Genius of Nature.” VERSES’ neurobiological approach to AI development is centered around the technique of Active Inference – a technique grounded in neuroscience and physics and led by VERSES’ Chief Scientist, Karl Friston.

AGI Market Opportunity

VERSES’ current portfolio of products, which includes an AI operating system called KOSM, an AI-powered personal assistant called GIA, and a newly launched AI-as-a-Service platform known as Genius, all offer good prospects for the company; however, the recent focus on AGI development is drawing increased interest to the company. I think this move towards AGI could address some investor skepticism regarding the company’s unique value proposition and the potential of VERSES’ Active Inference-based approach to AI development reaching mainstream use and adoption.

The realm of AGI goes beyond the current machine learning (ML) and natural language processing (NLP) trends, which are often categorized as artificial “narrow” intelligence (ANI). Narrow AI is trained on data for a specific task or a set of tasks and can solve problems within one narrow domain, while AGI systems are multipurpose and capable of learning, adapting, and possessing the flexibility and versatility to address a diverse range of real-world challenges with human-level intelligence.

VERSES claims its Active Inference tech stack recently achieved an internal “breakthrough,” which the company believes addresses the tractability problem of probabilistic AI. The company believes it is strategically positioned to become a market leader in the race to AGI and has highlighted the anticipation of market needs for AGI and preparation for the convergence of AI, Virtual Reality (VR), edge devices and sensors collectively known as the Internet of Things (IoT), and Robotics.

This advancement enables the design and deployment of adaptive, real-time Active Inference agents at scale, matching and often surpassing the performance of state-of-the-art deep learning.

– VERSES AI Press Release

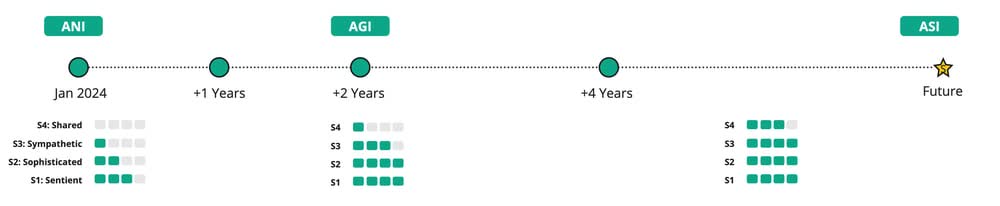

VERSES AI Roadmap (VERSES AI)

According to VERSES’ R&D roadmap, the company is gearing up for a significant foray into AGI development, with plans to delve deeply into AGI in the next two to three years and enhance AGI tractability through Bayesian scaling methodologies, transitioning AGI from a theoretical concept to a technology with practical, real-world utility.

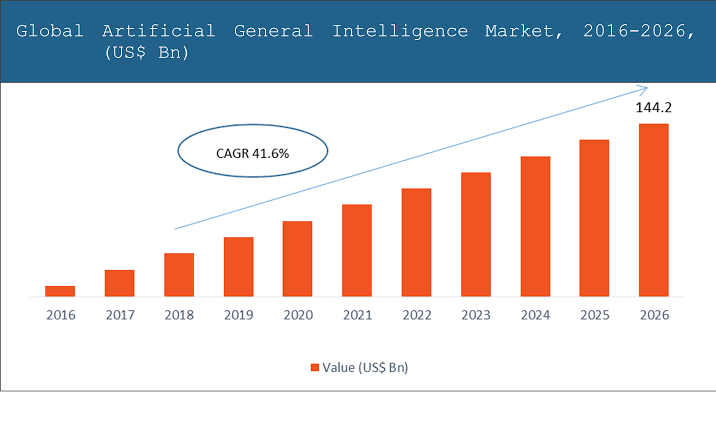

AGI Market Research Report (AllTheResearch)

AGI presents a great market opportunity for companies like VERSES. Industry research projects a growth rate of 41.6% CAGR for the global AGI market, reaching ~$144 billion by 2026. The AI market has continued to grow very rapidly, and it is projected to add $15.7 trillion to the global GDP by 2030.

VERSES Financials

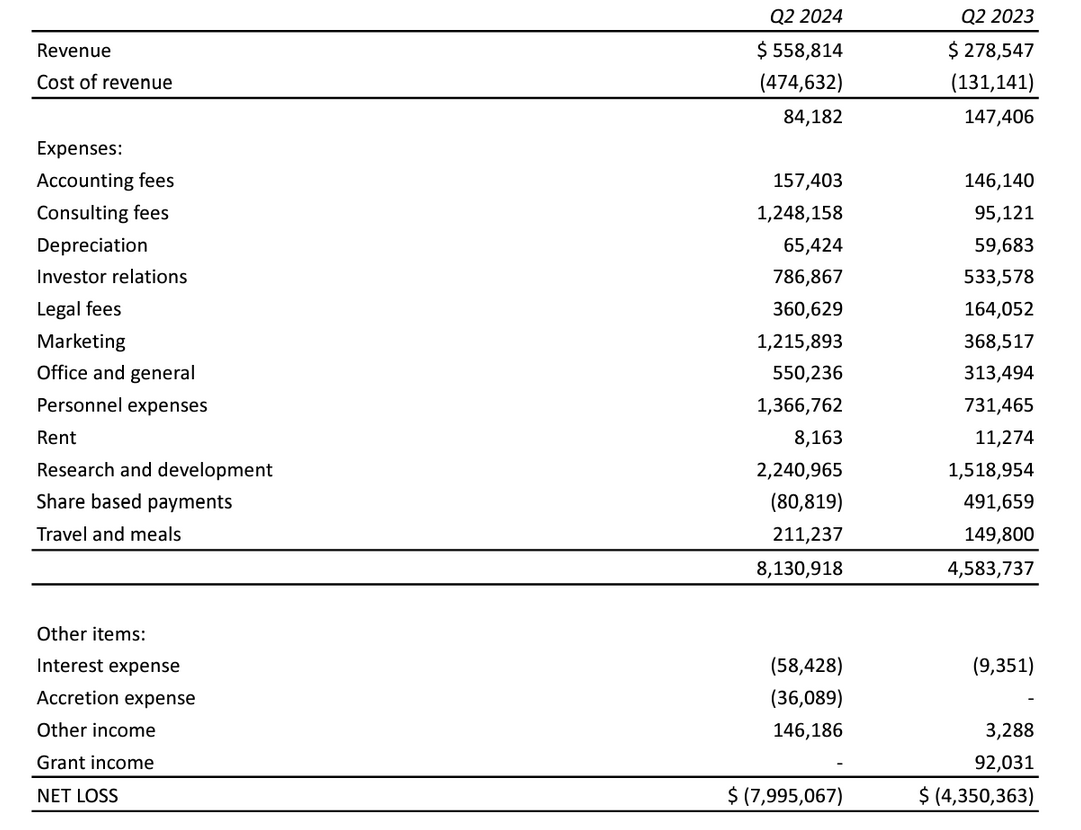

Income Statement (Company MD&A)

Recent results (for 2Q FY24) published in VERSES AI’s latest management discussion and analysis (MD&A) show that revenue is still low at a paltry ~$558k. Operating costs remain high, mainly due to SG&A and high R&D expenses. OpEx increased from $4.58 million in Q2 FY23 to $8.13 million in Q2 FY24, a 77% YoY rise. The hefty R&D spending doesn’t come as a surprise, as the AI field is research-intensive, especially considering VERSES’ novel approach to AI. While OpEx isn’t likely to drop soon, especially with VERSES’ venture into AGI which will demand ongoing R&D, keeping a close eye on sales in the coming quarters is crucial. If current products (KOSM, GIA, and Genius) don’t pick up sales, investors might need a rethink about this stock. Cash from sales is a must to fund ongoing R&D, without it, the company might turn to other funding methods, risking stock dilution or debt, making the stock less appealing. Even as VERSES’ software platform Genius reportedly gathers beta users, the real deal is turning those beta sign-ups into long-term customers and revenue in the long run.

VERSES’ valuation metrics, like the EV/Sales and P/S Sales, appear very stretched because of the low top line. I believe that when products (which are currently in the beta phase of development) are finalized and pushed to the market, then sales pick up, VERSES will see lower sales valuation metrics and will appeal to investors. The key factor is turning its innovative products into sales.

Takeaway

VERSES AI has produced technically impressive documentation and whitepapers and boasts a strong technical team headed by its Chief Scientist Karl Friston who is considered an Active Inference pioneer. However, I’m downgrading the rating for VERSES from a buy to a hold because of the persistent low revenue and increasing operating loss.

I am sorry to disappoint but I do not think we can deliver that [AGI] in 2024.

– OpenAI CEO, Sam Altman

The race to AGI is getting heated. Key players in the AI space, including OpenAI, have revealed plans for AGI. OpenAI’s CEO, Sam Altman, has acknowledged the surge in user requests for AGI and emphasized that the development of AGI is not feasible in 2024, as stated in his recent tweet

On paper, the VERSES Active Inference-based approach and whitepaper look promising. Could VERSES become one of the first companies that see an AGI breakthrough? I believe a short-term “wait-and-see” approach is a prudent one for this stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.